| East Bay Area April Housing Trends | |||

| Alameda, Contra Costa, Solano | |||

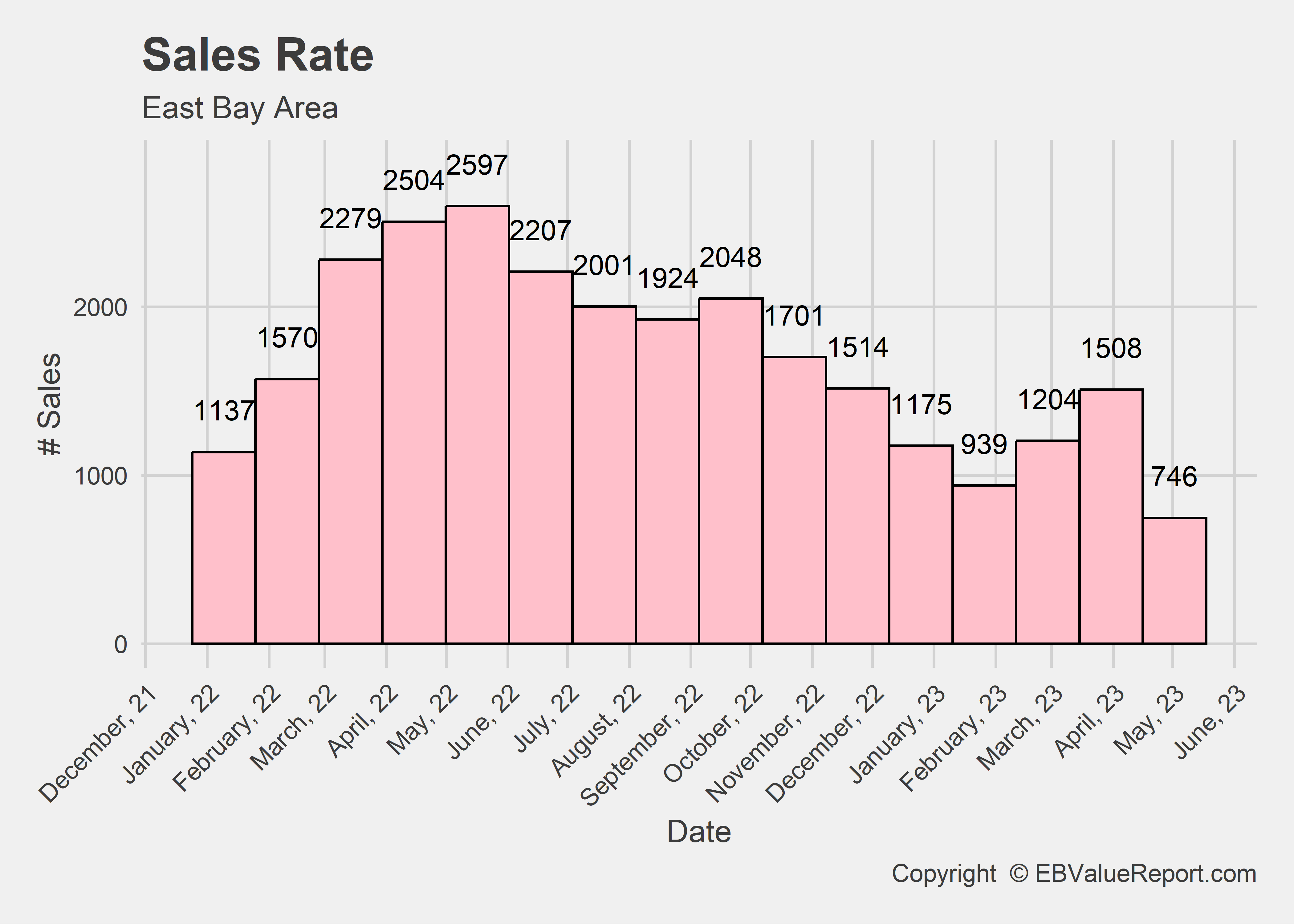

| 2022 | 2023 | % Change | |

|---|---|---|---|

| Median Price | 1100000 | 920000 | -16.4% |

| Average Price per SF | 695 | 789 | 13.5 |

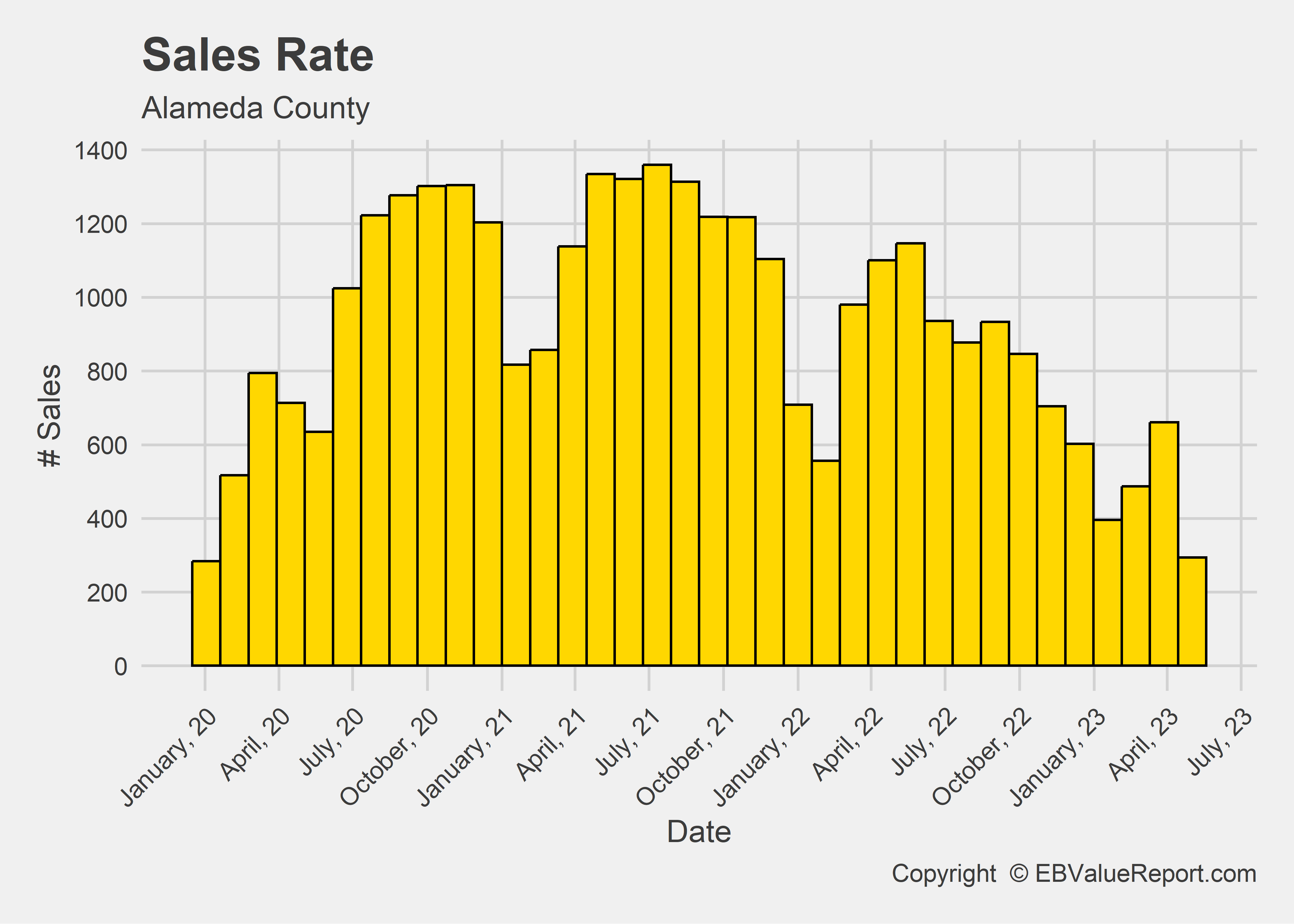

| Number of Sales | 2364 | 1414 | -40.2 |

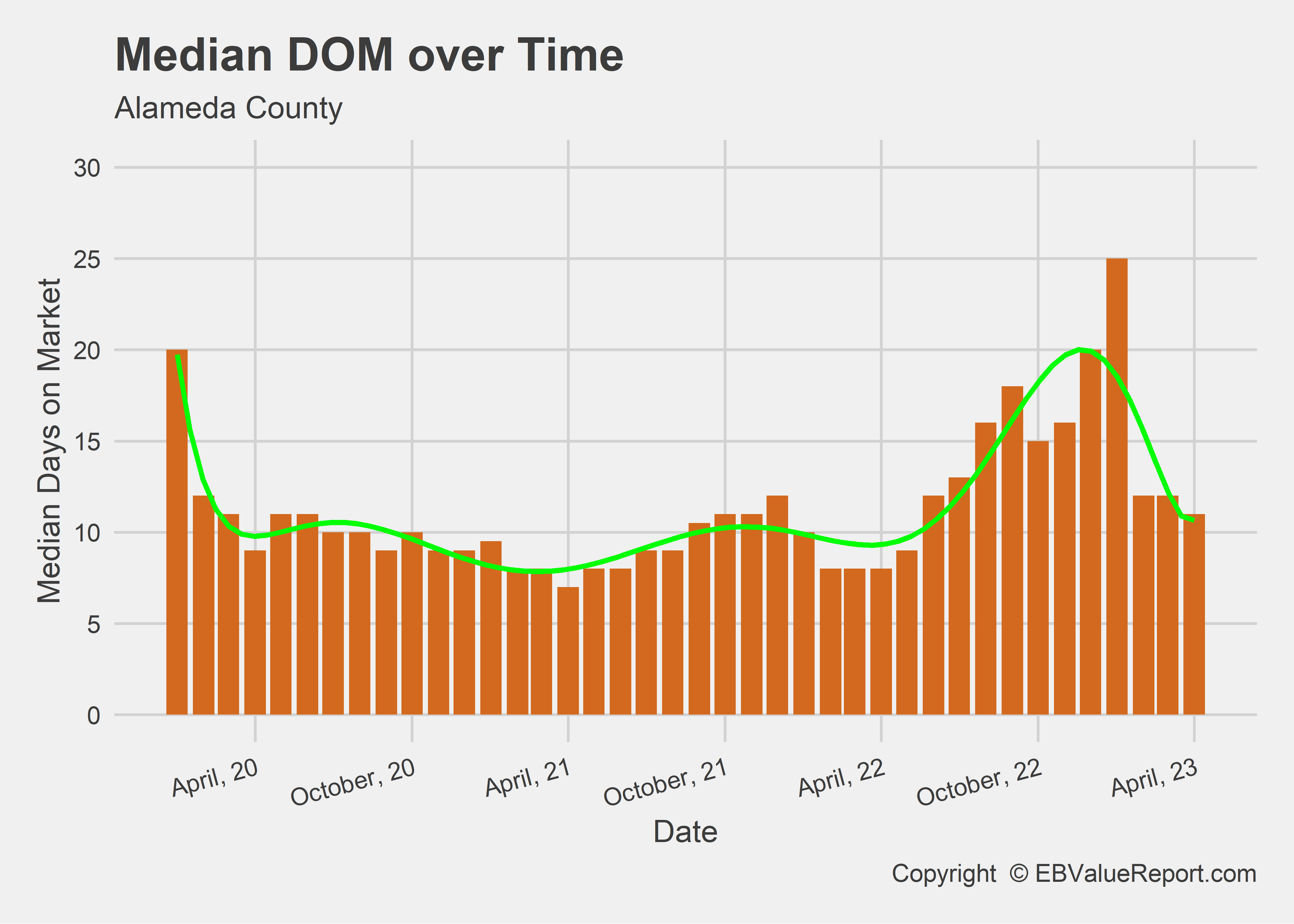

| Median DOM | 8 | 12 | 50.0 |

| Copyright © EBValueReport.com | |||

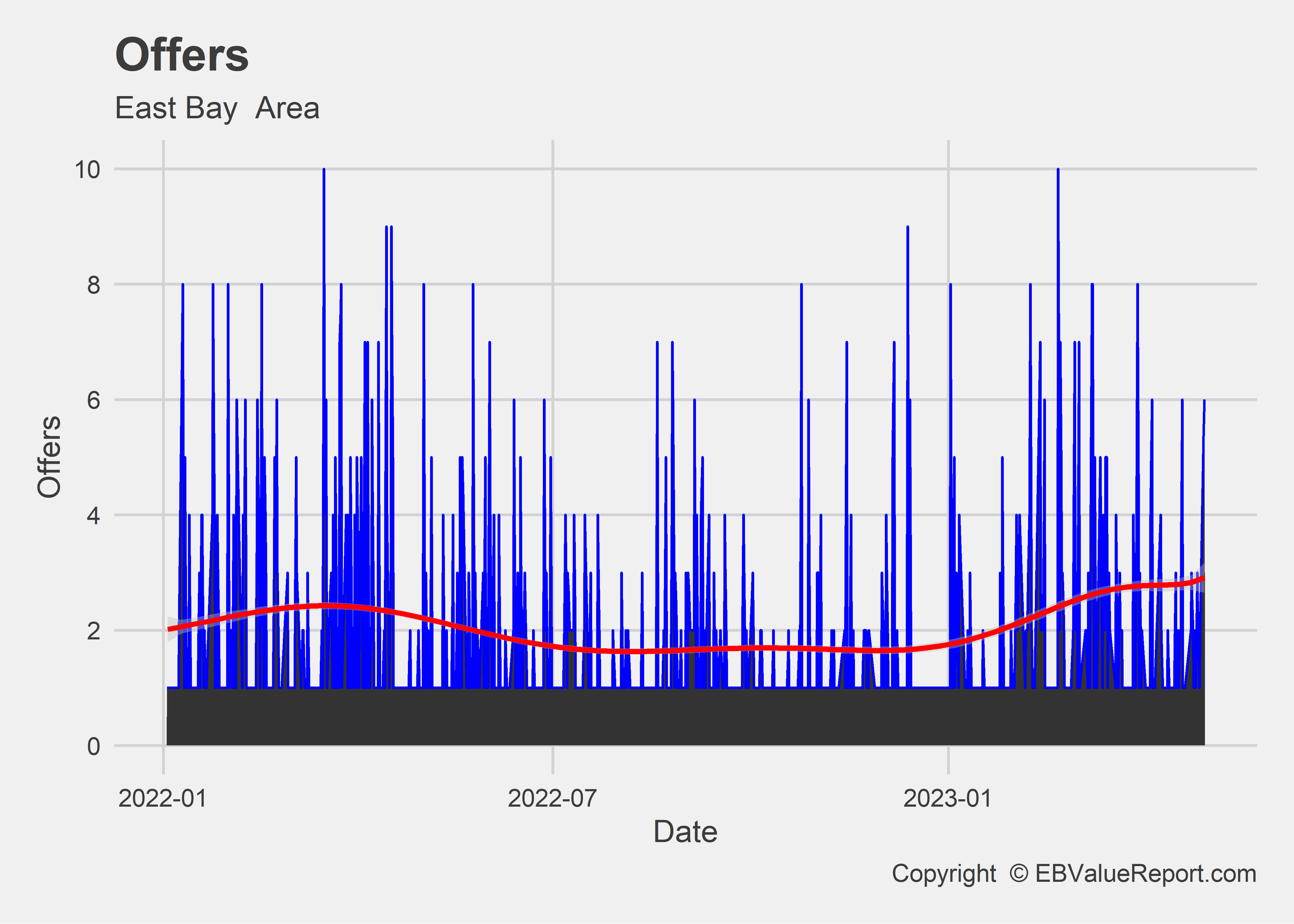

14 offers, 9 offers, 6 offers- all over asking price.

These are real stats from recent appraisals, showing ANOTHER significant changing trend in the market. Although there may be fewer buyers this year compared to last year, there are also fewer homes on the market. Hang tight, because this market is still in motion.

Mortgage and Me

This section is the summary of the ongoing sitcom, “Mortgage and Me”, where you get news of what the banks are doing and how it affects us all.

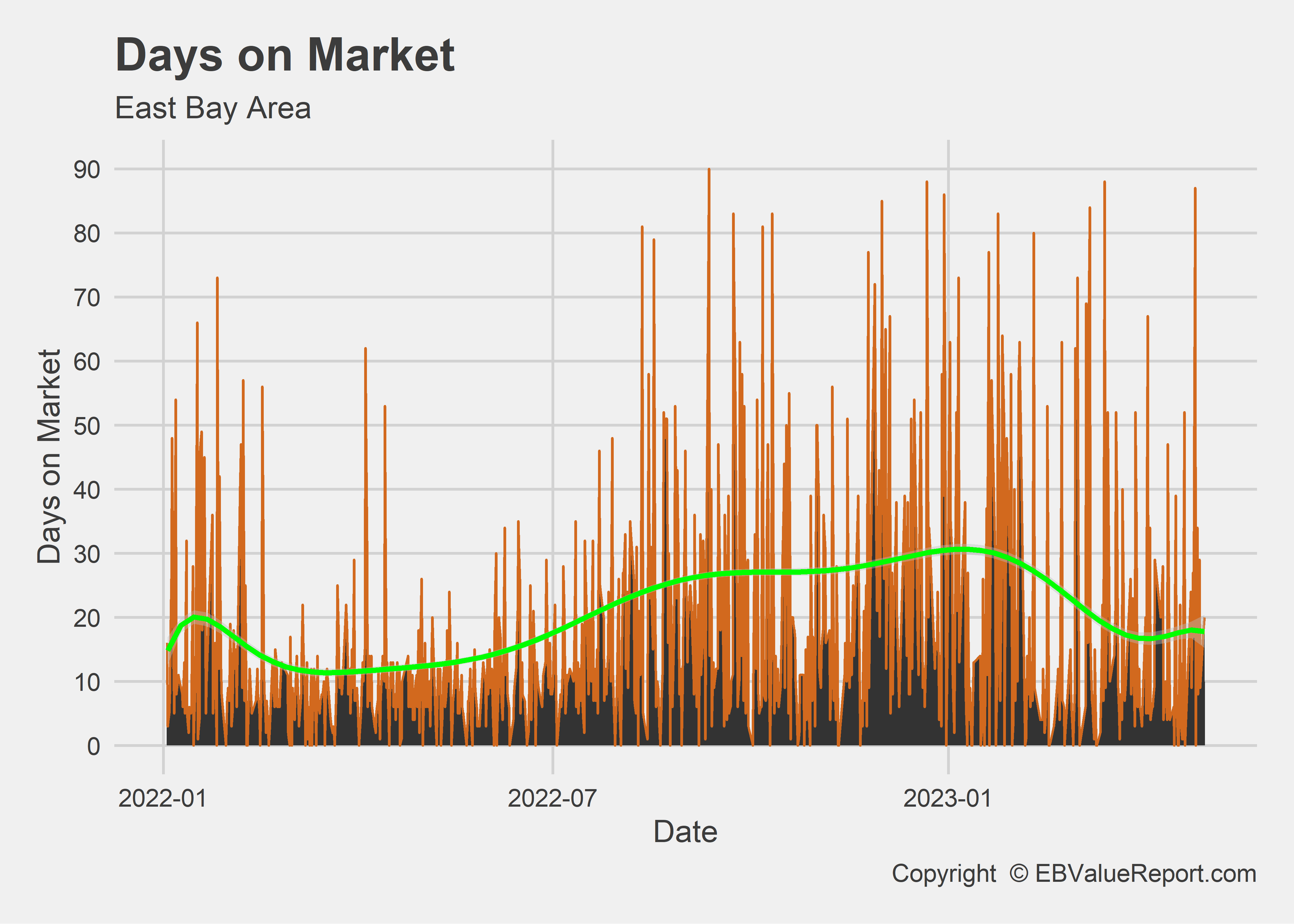

Mortgage Rates: Still Bouncing from 6-7%

The powers to be are all indicating that rates will likely lower as the year progresses. As I have written before, rates above 7% will mean price declines and rates below 5.5% will add more fuel to the fire.

Refinance Volume Stabilized

Normalized rates between 6-7% are giving owners a sence of the new “normal.” Loan officers are telling me that big banks have a huge advantage in this “higher” rate environment. Be sure you are working with knowledgeable people.

[Last month, I mentioned a new loan program for down-payment assistance. Well…it ran out of funds in less than a week. Apparently the Dream for All is the Dream for the Quick Fingered.]

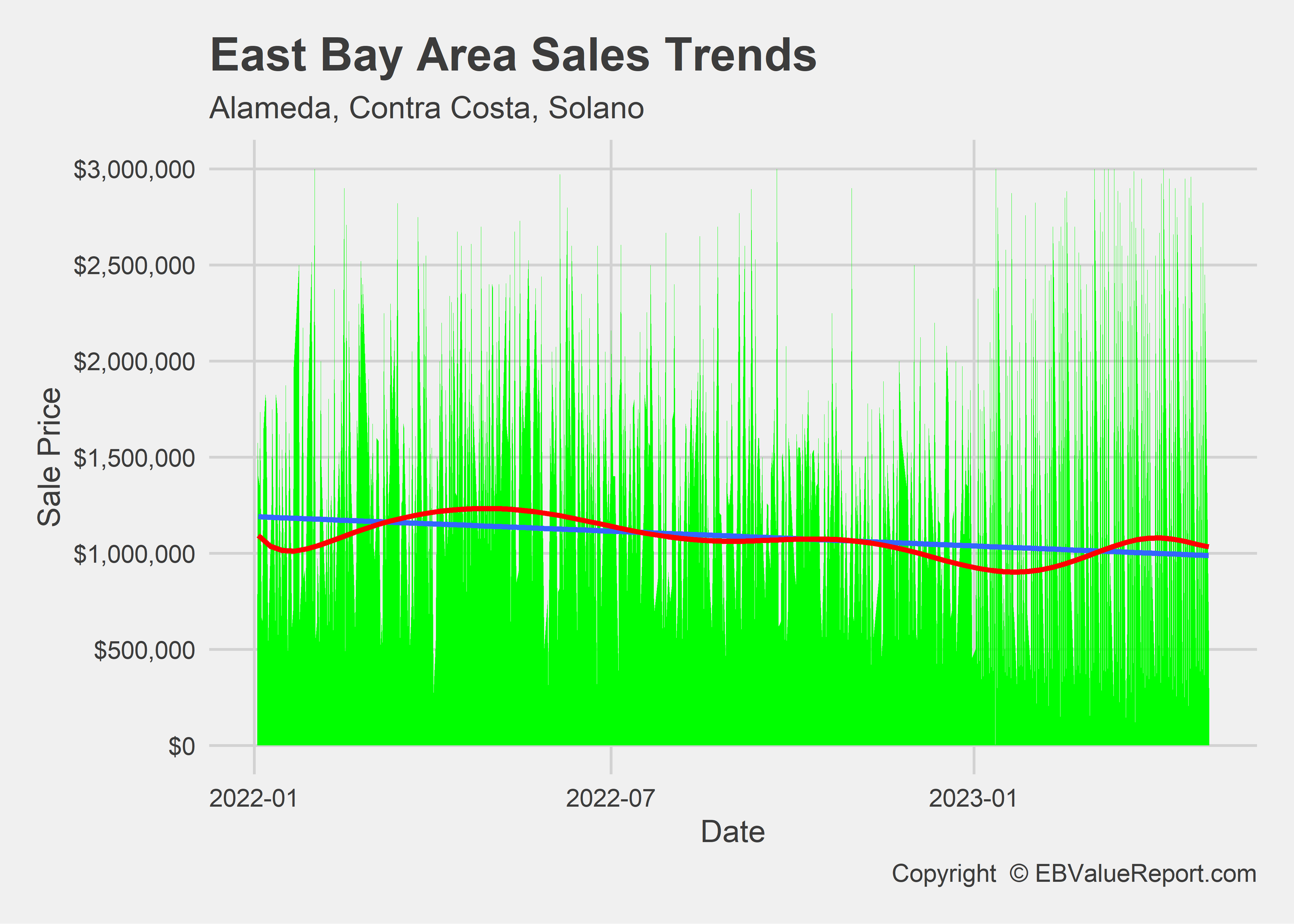

East Bay Area Market Update

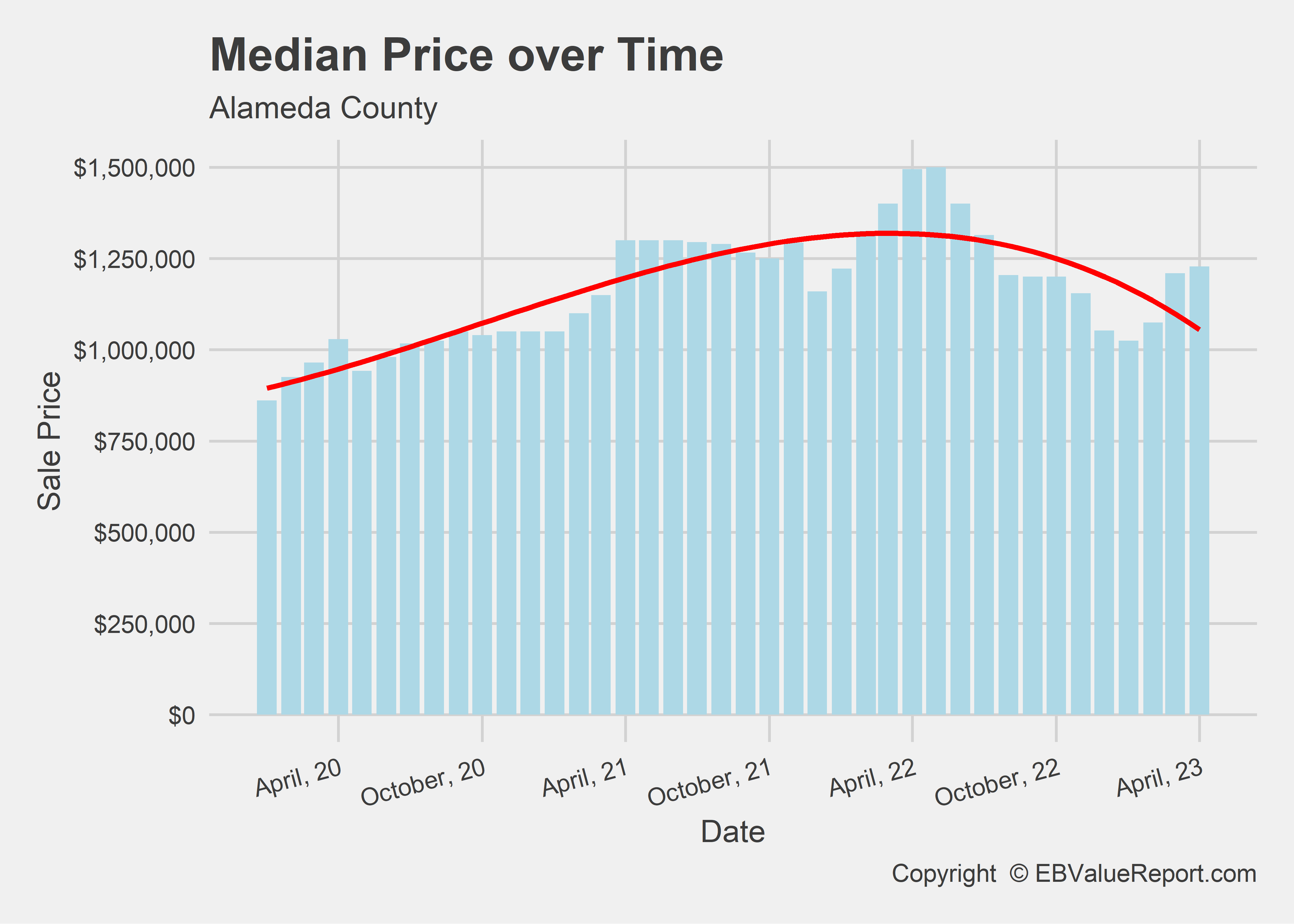

Homes in our three counties are selling for an average of 16% less than last year but the overall yearly trends seem to indicate a smaller percentage (likely half of that). Keep in mind that there were 40% less transactions this past month so if higher $$ homes don’t sell, it looks like prices are declining when the are actually stable.

Services for Agents

Listing Appraisals

Looking for a scientific analysis of a property that can assist your listing? You might be surprised what you can glean from our work. Send me an email to get started.

Speaking Events

Interested in a free presentation from your local appraisal expert? We offer many topics to assist agents including:

Market Updates

How to ROV [Rebutting an Appraisal]

Price per SqFt: The Big Misconception

Alameda Trends

Monthly trends indicate a modest increase in price likely due to a this area recovering quicker in February. Prices are in line with last fall (Aug, Sep, Oct).

| Alameda County Housing Trends | |||

| Detached Single Family Homes | |||

| March 2023 | April 2023 | % Change | |

|---|---|---|---|

| Median Price | 1210000 | 1227944 | 1.5% |

| Average Price per SF | 743 | 735 | -1.1 |

| Number of Sales | 585 | 554 | -5.3 |

| Median DOM | 12 | 11 | -8.3 |

| Copyright © EBValueReport.com | |||

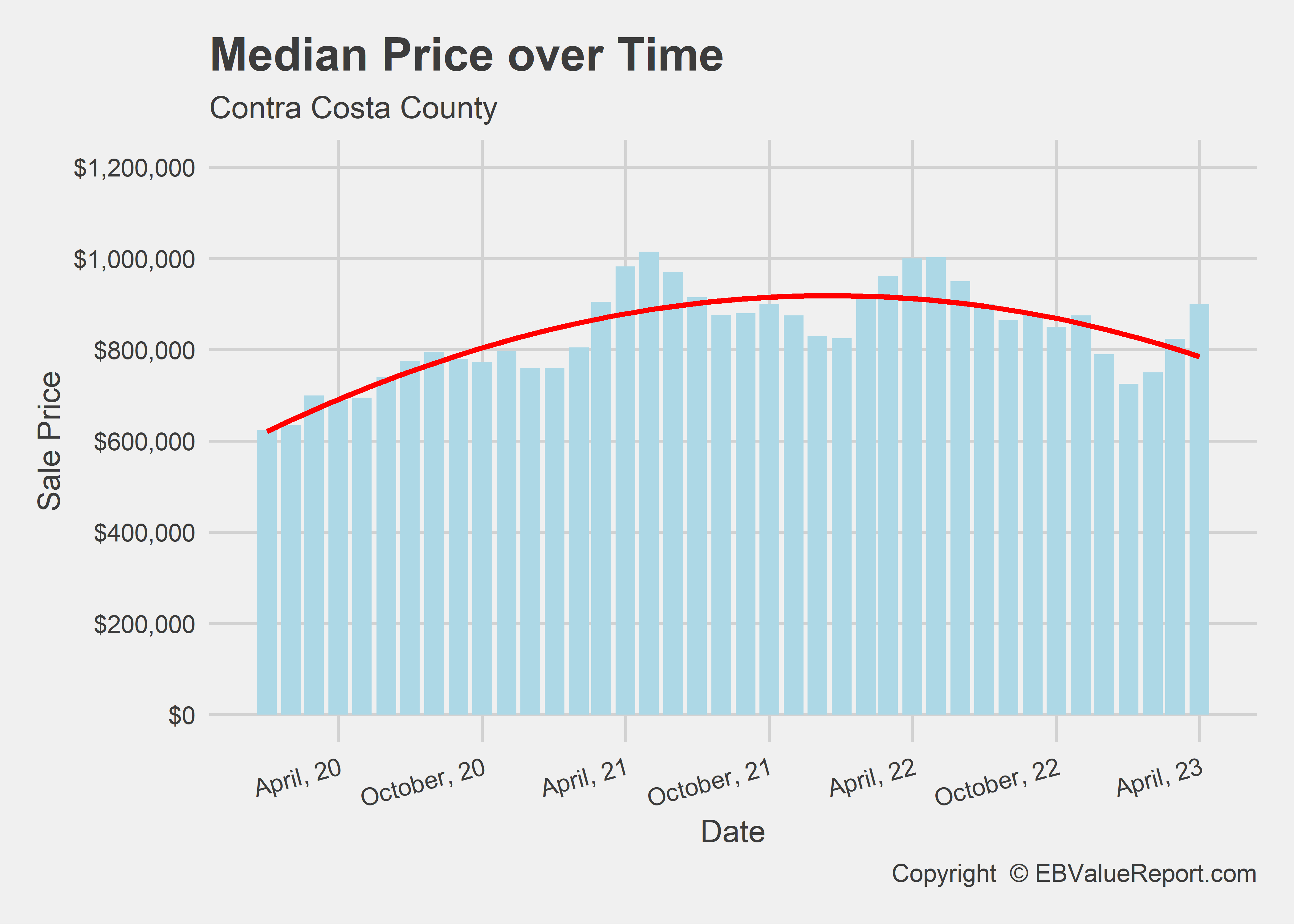

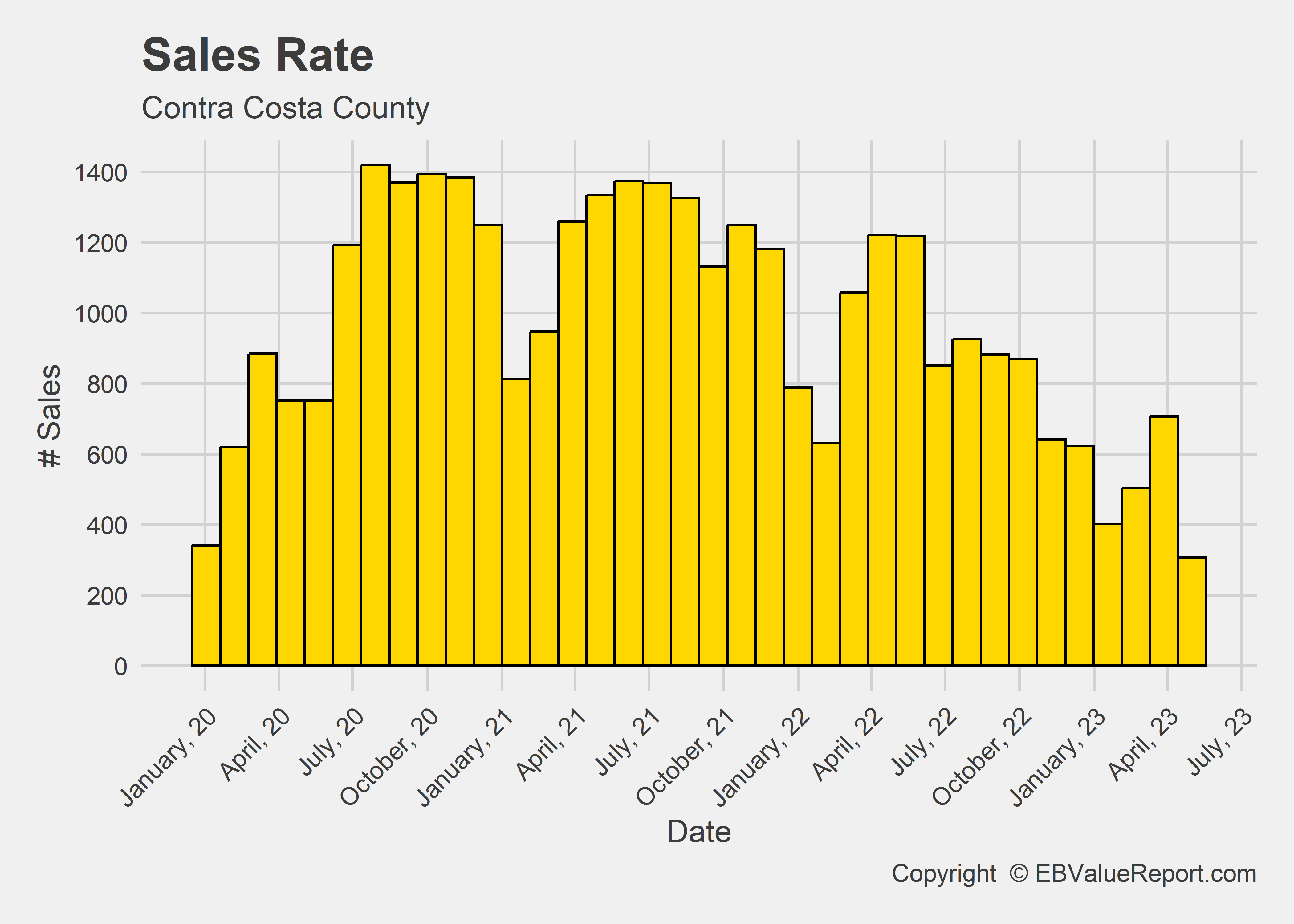

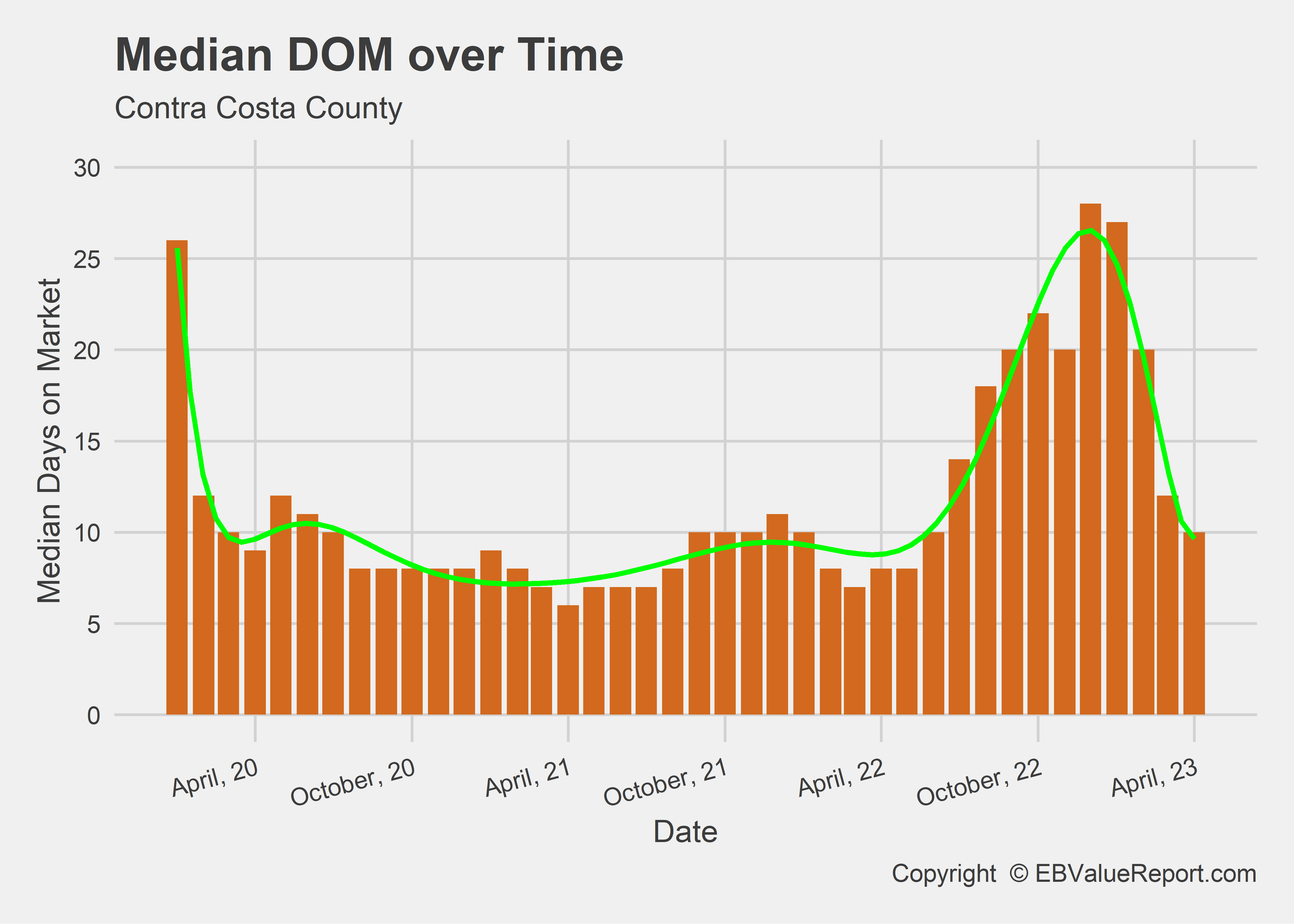

Contra Costa Trends

This area is seeing high competition and aggressive pricing.

| Contra Costa County Housing Trends | |||

| Detached Single Family Homes | |||

| March 2023 | April 2023 | % Change | |

|---|---|---|---|

| Median Price | 824000 | 900000 | 9.2% |

| Average Price per SF | 535 | 560 | 4.7 |

| Number of Sales | 631 | 587 | -7.0 |

| Median DOM | 12 | 10 | -16.7 |

| Copyright © EBValueReport.com | |||

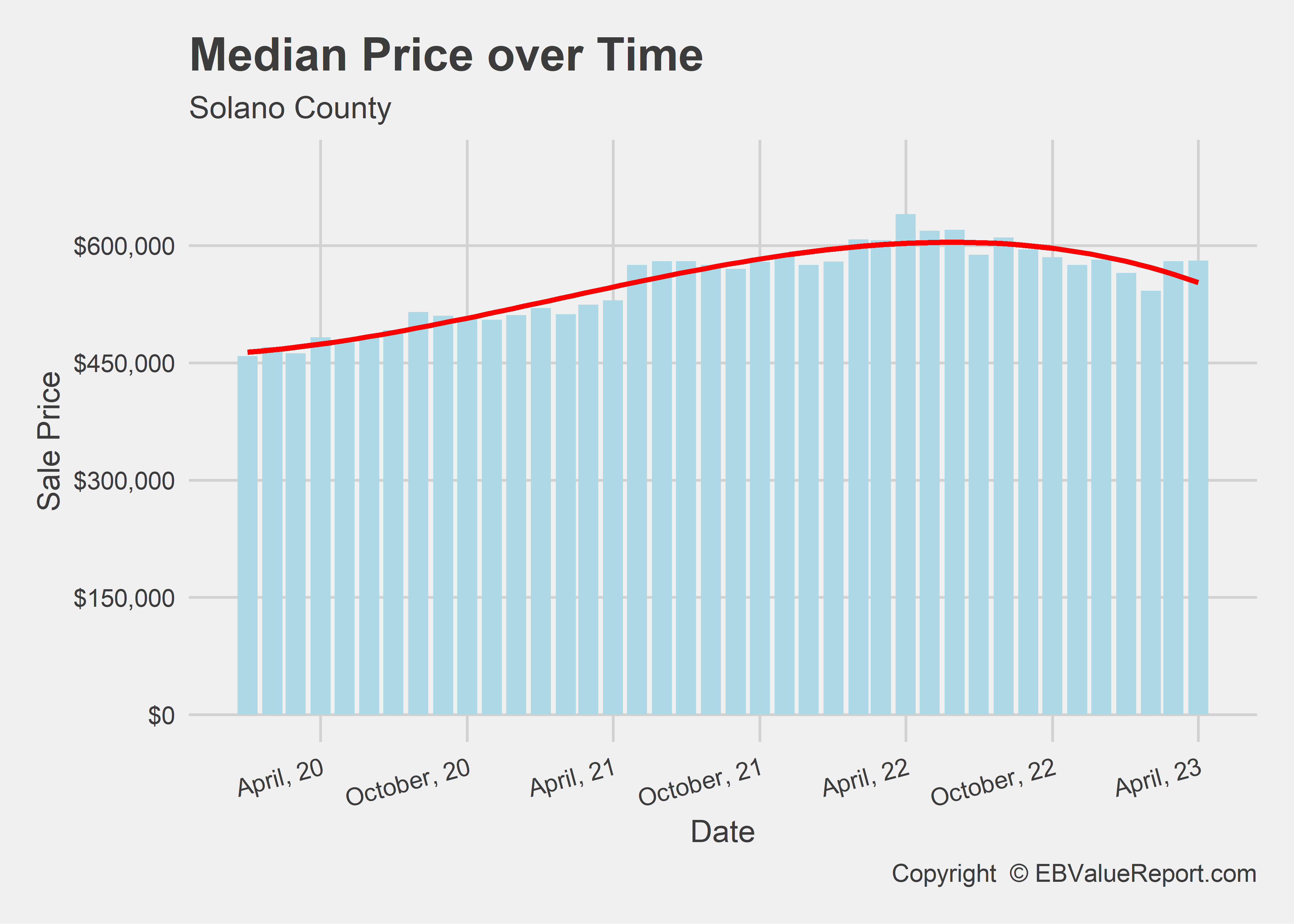

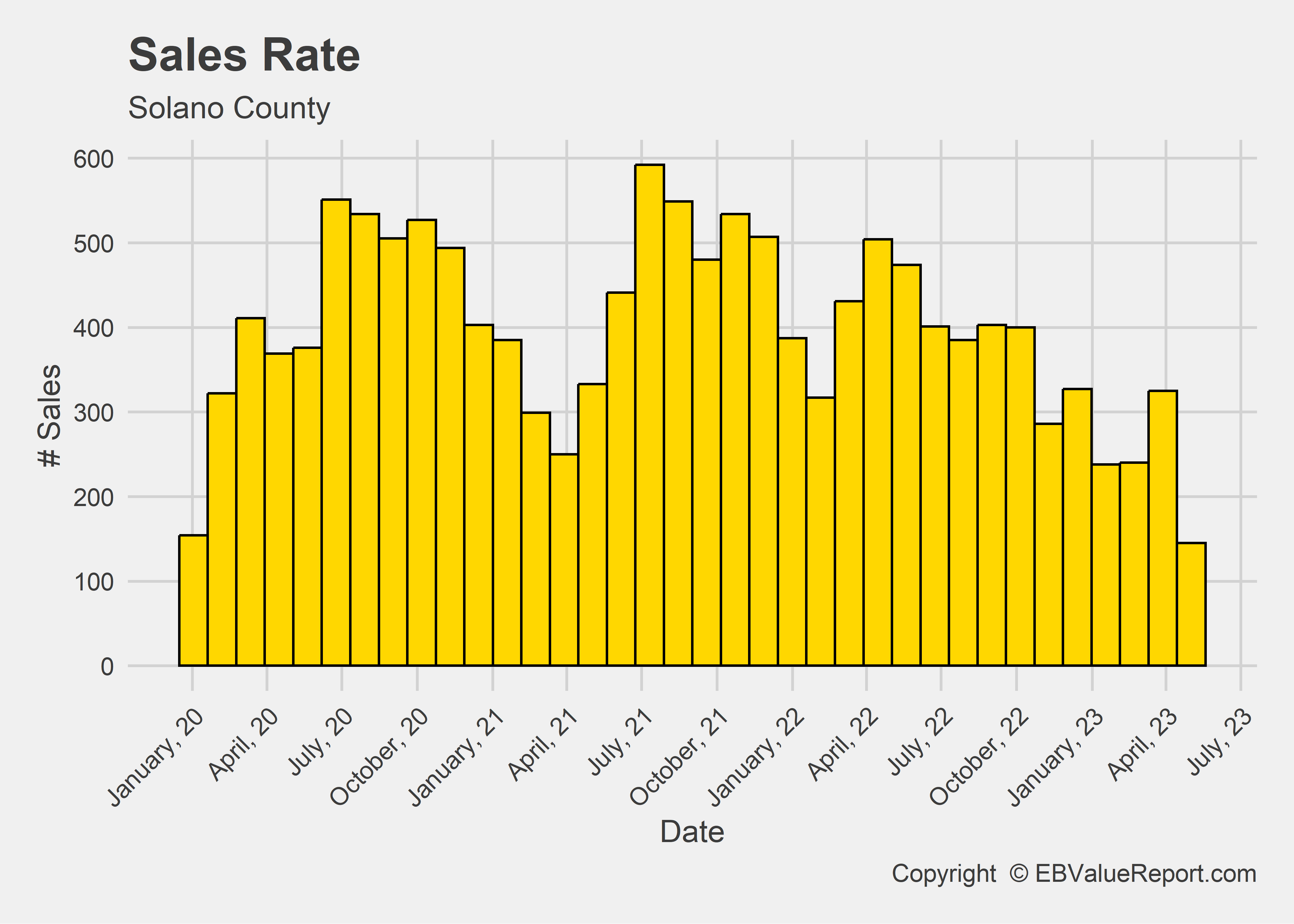

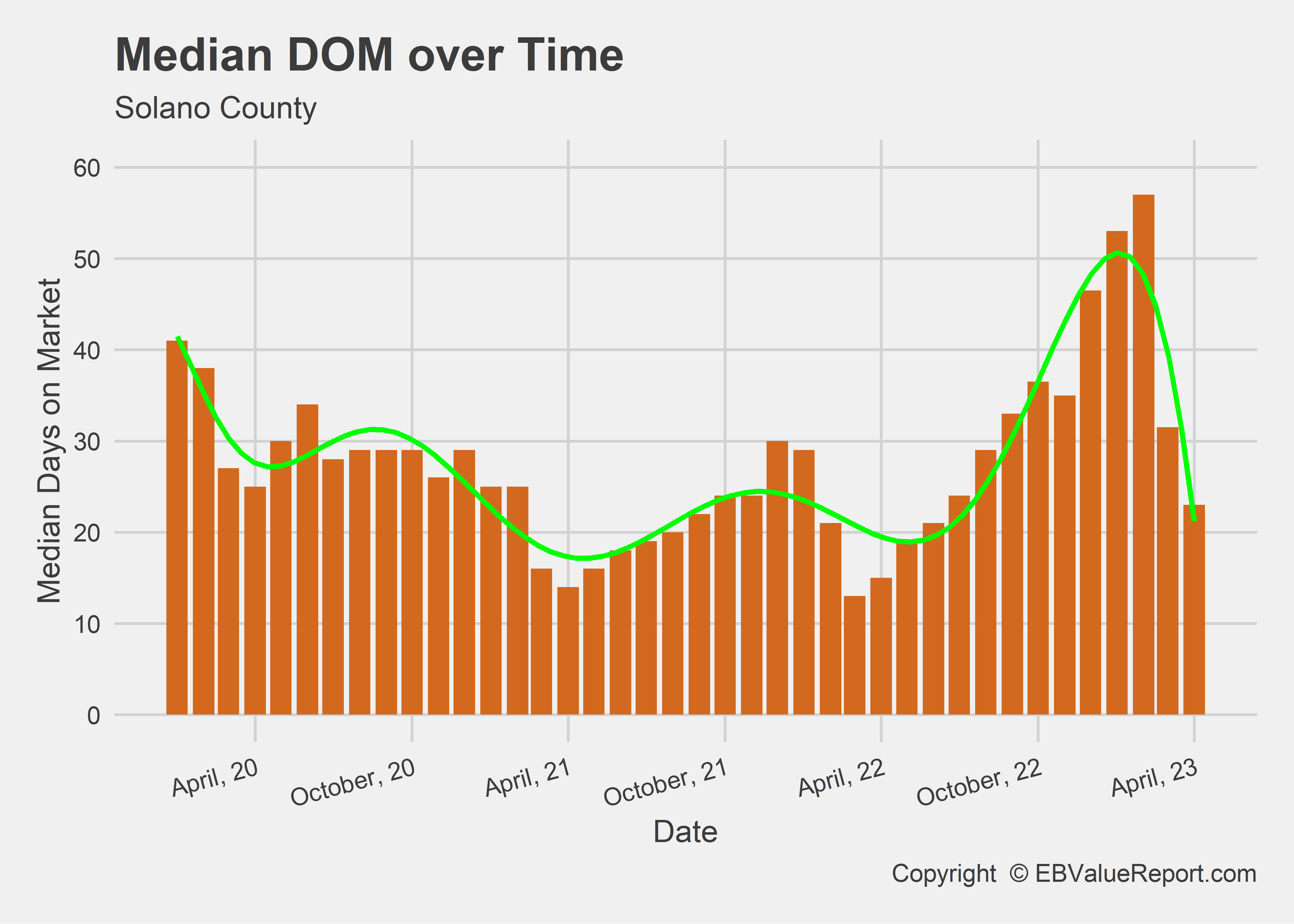

Solano Trends

These trends are steady and lacking the more pronounced high/low swings of Alameda or Contra Costa.

| Solano County Housing Trends | |||

| Detached Single Family Homes | |||

| March 2023 | April 2023 | % Change | |

|---|---|---|---|

| Median Price | 580000 | 580500 | 0.09% |

| Average Price per SF | 337 | 349 | 3.6 |

| Number of Sales | 306 | 272 | -11.1 |

| Median DOM | 32 | 23 | -28.1 |

| Copyright © EBValueReport.com | |||

Need a Referral?

This is my list of local people I trust with my business needs:

Loan Officer: Brian Regg - CMG Home Loans

Upholstery/Window Treatment Cleaning: Bobby Carrillo- Bayview Onsite Drapery Cleaning

Construction: Mark Fawcett- Precision Building and Design

Commercial Broker (Sales and Leasing): Peter Maclennan - Maclennan Investment Group

Services for Agents

Listing Appraisals

Looking for a scientific analysis of a property that can assist your listing? You might be surprised what you can glean from our work. Send me an email to get started.

Speaking Events

Book us for your brokerage and ask your burning valuation questions. We offer a range of topics, including market updates, how to rebut appraisals, and dispelling misconceptions around price per square foot.

Measurement Services

Agents! List that home with confidence with our measurement services. For a nominal fee, any new listing can have an “Appraiser-certified” statement of Square footage [SqFt] complete with a floorplan. Our services offer a more cost-effective and efficient solution than using a Matterport scanner, helping YOU streamline the sale and appraisal process. Give yourself and your clients peace of mind with our reliable and accurate measurement services. Contact us today to learn more.

Estate Appraisals

If you have client that needs appraisal work for estate, taxation or ligation purposes, we can help! Our firm services the East Bay Area, but we have a wide network of referrals and resources available for your clients. Contact us today to learn more about how we can assist your clients with their appraisal needs.

Our contact information

Office #: 925-937-3307

Email: office@valuableappraisal.com

Postscript

RIP- First Republic Bank

The people at FRB were the best in the businesses and never failed to live up to their reputation for excellent customer service. I am sad to see them go as a customer and vendor. First Republic was the only client of ours that held annual events for appraisers (champagne included).

Here is a photo from the last event hosted in San Francisco:

The view from the Crown Room at the Fairmont Hotel (2020 FRB event):

Now owned by JPMorgan Chase, First Republic became the 3rd bank to close in the past few months due to market volatility. I am looking for a new bank and would love some suggestions.

Thanks for reading this market update.

.png)

.png)